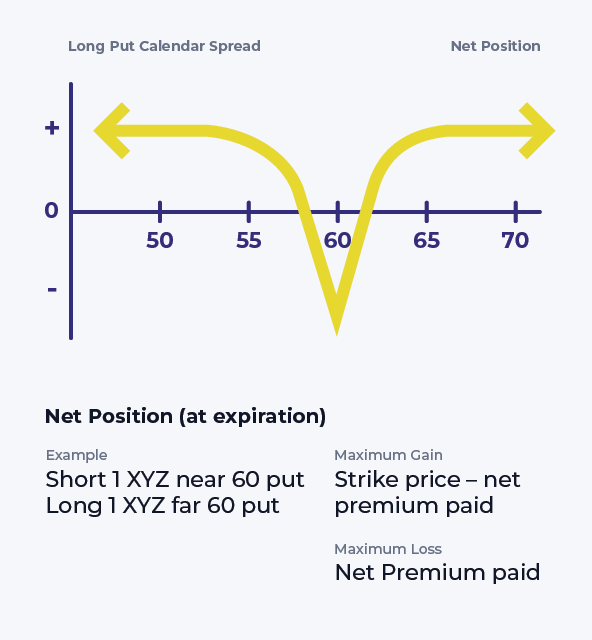

Long Put Calendar Spread - Web the objective for a long call calendar spread is for the underlying stock to be at or near, nearest strike price at expiration and take. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Web long put calendar spreads profit from a slightly lower move down in the underlying stock in a given range. Web the short calendar put spread is a strategy that can be used when you have forecasted that a security will move sharply in price,. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web a long put calendar spread involves buying and selling put options for the same underlying security at the same. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having. Web a long calendar spread consists of two options of the same type and strike price, but with different expirations.

Calendar Put Spread Options Edge

Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web a long put calendar spread involves buying and selling put options for the same underlying security at the same. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Web the objective for a long call calendar spread is for the underlying stock to be at or near, nearest strike price at expiration and take. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but.

Long Calendar Spread with Puts Strategy With Example

Web the short calendar put spread is a strategy that can be used when you have forecasted that a security will move sharply in price,. Web a long calendar spread consists of two options of the same type and strike price, but with different expirations. Web long put calendar spreads profit from a slightly lower move down in the underlying.

Bearish Put Calendar Spread Option Strategy Guide

Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web the short calendar put spread is a strategy that can be used when you have forecasted that a security will.

Put Calendar Spread

Web the objective for a long call calendar spread is for the underlying stock to be at or near, nearest strike price at expiration and take. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but.

Long Calendar Spreads Unofficed

Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having. Web a calendar spread is an option.

Long Put Calendar Spread (Put Horizontal) Options Strategy

Web a long put calendar spread involves buying and selling put options for the same underlying security at the same. Web the short calendar put spread is a strategy that can be used when you have forecasted that a security will move sharply in price,. Web the objective for a long call calendar spread is for the underlying stock to.

Bearish Put Calendar Spread Option Strategy Guide

Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having. Web the short calendar put spread is a strategy that can be used when you have forecasted that a security will move sharply in price,..

Bearish Put Calendar Spread Option Strategy Guide

Web a long calendar spread consists of two options of the same type and strike price, but with different expirations. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web the short calendar put spread is a strategy that can be used when you have forecasted that a security will move.

Bearish Put Calendar Spread Option Strategy Guide

Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web a long calendar spread consists of two options of the same type and strike price, but with different expirations. Web.

Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having. Web the objective for a long call calendar spread is for the underlying stock to be at or near, nearest strike price at expiration and take. Web a long put calendar spread involves buying and selling put options for the same underlying security at the same. Web long put calendar spreads profit from a slightly lower move down in the underlying stock in a given range. Web a long calendar spread consists of two options of the same type and strike price, but with different expirations. Web the short calendar put spread is a strategy that can be used when you have forecasted that a security will move sharply in price,.

Web Long Put Calendar Spreads Profit From A Slightly Lower Move Down In The Underlying Stock In A Given Range.

Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having. Web the short calendar put spread is a strategy that can be used when you have forecasted that a security will move sharply in price,. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short.

Web The Objective For A Long Call Calendar Spread Is For The Underlying Stock To Be At Or Near, Nearest Strike Price At Expiration And Take.

Web a long put calendar spread involves buying and selling put options for the same underlying security at the same. Web a long calendar spread consists of two options of the same type and strike price, but with different expirations.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)